You may be ready to move on from an apartment but not quite ready for an entire house. That’s where a condo or a townhouse would come in! Before you decide to buy or rent a townhouse or a condo, make sure you understand the difference between the two and how that affects your decision.… Read More

Galaxy Lending Group's Blog

AWith everything going on in the world right now, you may be finding that your wallet is a little tighter than normal. It’s always a good idea to track your spending and be smart with your habits, but now is the perfect time to really buckle down and stick to a budget. Creating a personalized… Read More

Private Mortgage Insurance, often abbreviated as PMI, can be defined as insurance that the borrower must pay to the lender until a certain amount of the loan is paid off. It keeps the lender financially secure, in case the borrower fails to pay the loan amount. It generally comes into picture when the borrower has… Read More

Buying a home rates as one of the most important decisions made by an individual. It’s emotionally, mentally as well as financially monumental. Many people believe that buying a home is something far off in the future. However, a wide variety of programs exist to help first-time homebuyers purchase a home sooner than expected. The… Read More

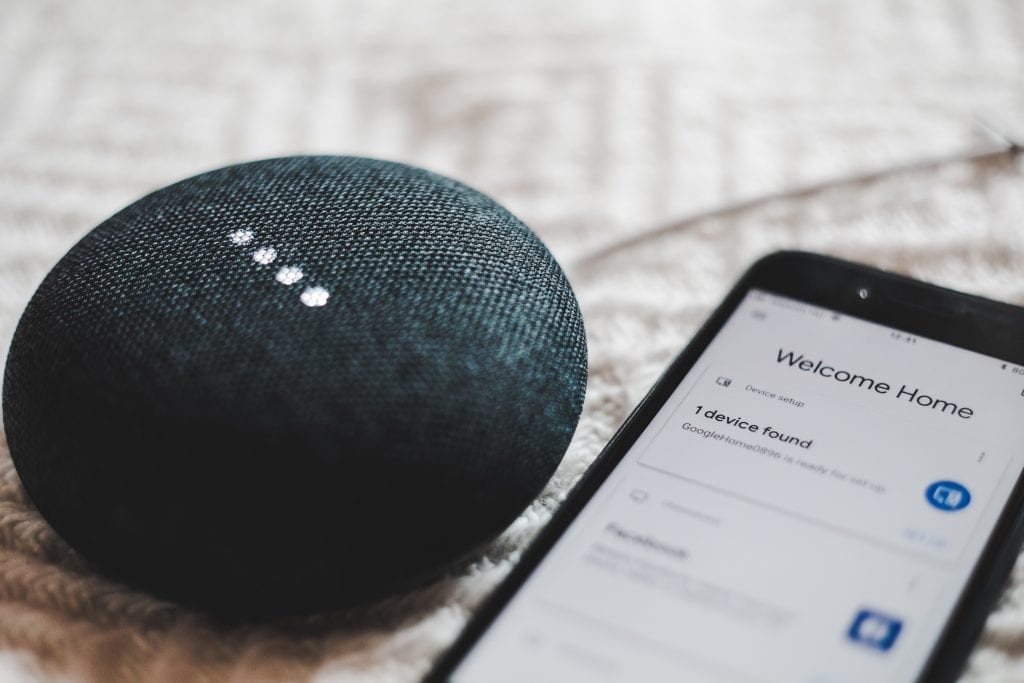

Smart home technology has really improved and grown over the last few years. Pretty much anything you can think of to add to your home is on the market somewhere. Companies are constantly creating new gadgets to improve our lives, but the abundance of products can be overwhelming. We’ve put together a simple list of… Read More

If you’re looking to buy a new home or refinance your current one, you may have heard the terms mortgage points or credits being thrown around. So, what are those and what do they do for you? And when do you know if you should take them out? Points and Credits Defined Before deciding your… Read More