Points and Credits: Are they right for you?

If you’re looking to buy a new home or refinance your current one, you may have heard the terms mortgage points or credits being thrown around. So, what are those and what do they do for you? And when do you know if you should take them out?

Points and Credits Defined

Before deciding your stance on points and credits for your mortgage, let’s go over simple definitions first.

Points – These can also be called “discount points” and are essentially a one-time fee that you pay at closing to give you a lower interest rate. It’s a tradeoff because you’ll be paying more in closing costs but less month over month because of the lower rate.

Credits – Also called “lender credits”, these are the exact opposite of points. You’ll have a higher interest rate in exchange for paying less in closing costs or even having your lender pay for them entirely. In other words, you’ll be getting a credit during closing that you’ll pay off later through the monthly payments.

Points and credits are calculated as a percentage of the total loan amount. One point is equal to 1% of the mortgage loan. For example, if you have a loan of $200,000, then 1 point is 1% of $200,000, or $2,000 upfront that you’ll pay at closing. The discount on your interest rate depends on your lender and the loan that you are taking out but is generally 0.25% per point.

Which is better?

Points and credits can both be beneficial depending on the situation. So how do you choose between the two or neither at all? That all depends on how long you plan on keeping the property that you’re purchasing or refinancing with the loan.

As a general rule, if you’re planning on keeping your property for a long time, it would be more beneficial to purchase points. You’ll pay more upfront, but you’ll pay a lot less in the long run over the lifetime of your loan. If you don’t plan on staying in the home for more than a few years, then it may be better financially to take credits and pay less upfront since you won’t stick around long enough to see the benefits from long-term savings.

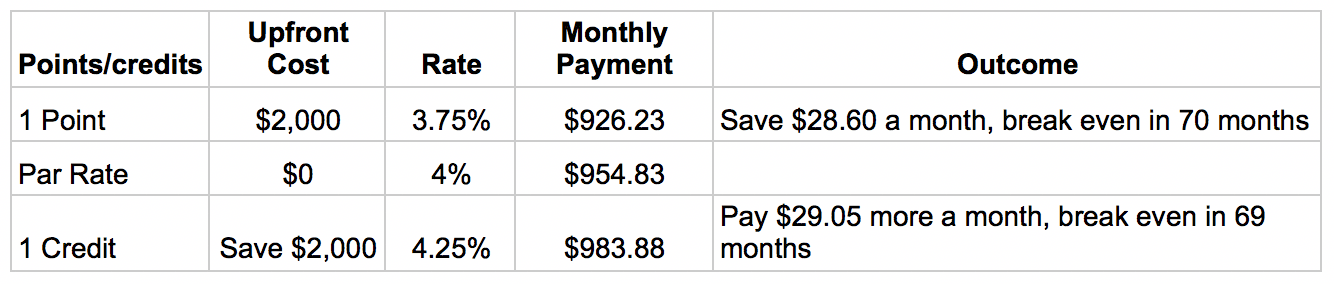

The table below reflects how different situations could affect a loan amount of $200,000

If you choose to pay a point on a $200,000 loan, you’ll pay $2,000 upfront at closing in order to get a rate 0.25% lower. This will result in a monthly savings of $28.60 and a breakeven point at 70 months, meaning that the upfront payment will have been worth it for the savings as long as you stay living there and paying that mortgage for a little under six years. If you sell before then, the point wouldn’t have been worth it because you paid more upfront than you saved over time.

If you choose to take a credit on that same loan, you’ll pay $2,000 less at closing but have a rate 0.25% higher. Your monthly payment would be $29.05 more, and you would break even at 69 months. This means that if you stay in your home for less than 69 months, the credit would have been worth it because you saved more upfront than you paid extra overtime for the interest. But if you stay longer than 69 months, then you’ll be paying more monthly than you had originally saved. In that case, it might be worth it to look into refinancing your home to get a lower rate.

Points and credits can be beneficial depending on your individual situation. To learn more about which would be the best choice for you, contact one of our licensed loan officers today. Galaxy Lending Group is here to help you navigate the world of mortgages and home buying to help you finance your dream home.