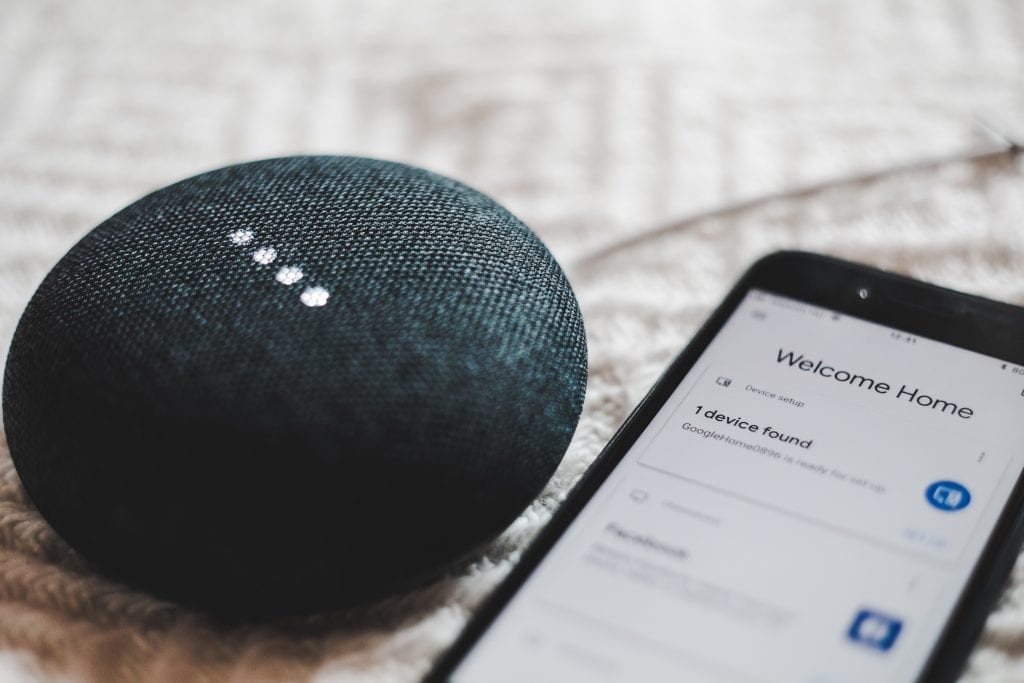

Smart home technology has really improved and grown over the last few years. Pretty much anything you can think of to add to your home is on the market somewhere. Companies are constantly creating new gadgets to improve our lives, but the abundance of products can be overwhelming. We’ve put together a simple list of… Read More

Galaxy Lending Group

If you’re looking to buy a new home or refinance your current one, you may have heard the terms mortgage points or credits being thrown around. So, what are those and what do they do for you? And when do you know if you should take them out? Points and Credits Defined Before deciding your… Read More

Maybe you want to lose weight, save money or spend more time with family and friends. But what about your home? Whether you’re getting ready to sell your home or just want to improve the place that you spend most of your time, we’ve created a list of the best home improvement resolutions you can… Read More

How are you going to save thousands of dollars on top of all your normal expenses? It may seem impossible at first, but there are plenty of little changes that you can make to help you put away enough money for a sizeable down payment, which will save you a lot more money in the… Read More

There are a few steps in the process of making an offer that you’ll need to go through. You’ll want to ensure that this house is the one that you want to make your home, then decide how much to offer, write an offer letter and negotiate. We’ll walk you through each step to help… Read More

The best time of year to buy a home is dependent on many factors. The market may be bigger in summer, but it will be cheaper in winter. There are also personal factors, such as wanting to get into a new home before your kids go back to school or needing to move closer to… Read More